You are hereHabitat 1982- / Licensing Managers

Licensing Managers

LICENSE TO MANAGE

LICENSE TO MANAGE

By TOM SOTER

JANUARY 2002

For a medical problem, you see a doctor; for a legal one, a lawyer; for a financial one, an accountant. It’s the same with your building, too: for a management difficulty, you should turn to a managing agent. It’s the same, except it’s not. Doctors, lawyers, and accountants are all licensed by the state and face the loss of their license if they act incorrectly. A managing agent, however, is unlicensed.

That’s no joke. Unlike most other professions, almost anyone can hang out a shingle and call himself a manager. And many do, with impunity. “Right now, anyone can become a property manager,” says Leonard Jones, president of the New York Association of Realty Managers (NYARM), a trade association. “The property is valuable, but we have instances, where people who never managed property before do so. They have a lot of influence over a lot of people. Our organization offers training but no law says they have to do that. A lot don’t.”

The consequences can be dire. An incompetent agent can run a property into the ground, mismanaging finances and capital systems. A corrupt manager can steal – and many have, as two rounds of kickback indictments, plea bargains, and confessions have made clear.

“Property managers are responsible for the life and safety and funds of millions of people,” says David Kuperberg, president of Cooper Square Realty. Having [no requirements] is unconscionable. Plumbers and taxi drivers have to be licensed, So should property managers.”

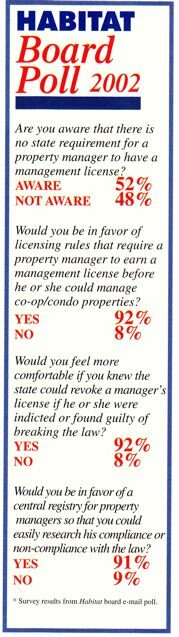

Yet boards seem unaware of the lack of licensing, while many in the industry seem content with the status quo. How did we get here – and is there anything that can be done?

LICENSE TO KILL

In general, when is licensing necessary? According to Douglas Kleine, executive director of the National Association of Housing Cooperatives (NAHC), licensing is most obviously necessary when there is a need to protect the health and safety of consumers (with electricians, for instance). Less obvious situations involve:

(1) KNOW-HOW. Some licensing may be necessary where the practice or profession takes a very high degree of knowledge. Minimum educational requirements from accredited sources are the usual response. “A disparity of knowledge between provider and consumer may leave the consumer at a disadvantage in the transaction,” Kleine notes. “The appropriate response is to level the playing field by restricting certain practices or requiring ‘best practices’ and enforcing through licensing and revocation.”

(2) DECEPTION. Some situations are rife for deception by the party with the greater knowledge. “The correct response is consumer protection, restitution, and criminal sanctions,” he says.

(3) ADVERSARY TRANSACTIONS. Some transactions are adversary transactions (such as buyer-seller and landlord-tenant) in which, Kleine states, “licensing is necessary to protect one of the parties, usually though disclosure to ensure fair play, and sometimes with cooling off periods as an enforcement mechanism.”

So what about managers? It is not completely accurate to say that agents are unregulated. Legally, a management firm must have a license. But it is not one that has much to do with the skills needed as a property manager. Under state law, a firm must have a broker’s license.

The reason goes back to the origins of modern management: when the licensing requirements were put in place, most New York City agents worked for owners of rental properties; they usually answered to one person – the landlord – and were primarily licensed because they had to handle financial transactions: collecting the rent and negotiating leases. The law clearly spells that function out. Article 12-A of the Real Property Law provides that anyone who, on behalf of another and for a fee, (1) negotiates a sale, exchange or rental of real property, (2) collects rent, or (3) negotiates a commercial loan secured by a mortgage must be licensed as a real estate broker, must be licensed as a real estate broker.

In order to qualify for licensure as a real estate broker, an applicant must have at least one year of experience as a licensed real estate salesperson or at least two years of experience in the general real estate field (e.g., buying and selling property or managing property owned by an employer), have satisfactorily completed both the qualifying salesperson course of 45 hours and an additional 45-hour real estate broker course as approved by the secretary of state, and have passed a qualifying examination administered by the state.

The courses, offered by a number of organizations including the Real Estate Board of New York (REBNY) and New York University, cover a range of topics, including management. The REBNY course is typical, including courses in estates, deeds, leases, contracts, titles and closing costs, land use regulations, construction, valuation, human rights and fair house, the environment, real estate mathematics, taxes and assessements, rent regulation and sign ordinances, and real estate property management.

“A substantial portion of the course requirements relate to property management,” says Marolyn Davenport, at REBNY. “We have tried to make ours very relevant to property management.”

Yet, out of 26 sections in the REBNY course, one is devoted to management for commercial, industrial, rental, and co-op/condo properties. Ronni Lynn Arougheti, a principal in Heron Management, teaches the management portion of the course: a five- to six-hour, one-day session, from 9 to 4. She admits that the session only touches on each subject but says: “Nothing can be a substitute for practical experience. When I teach the course, I try to give them lessons from practical experience in how to solve problems.”

Many argue that the courses do not adequately address the full-range of management duties – and that the skills needed by a good manager are vastly different from those needed by a good broker. “Management is a minute portion of the REBNY course,” says Michael Wolfe, president of Midboro Management. Adds NYARM’s Jones: “It doesn’t doesn’t teach you how to deal with the technical and practical side of property management. It’s really a broker’s course.”

Arougheti, also an officer with REBNY, says that the initial license is just a first step – managers can and should take more comprehensive, management-related courses under the continuing education portion of the law. But there is no absolute requirement that agents take rigorous management courses; they can opt for less-intense broker-related subjects.

without one.Or, practically, they can do nothing at all. According to many in the industry, countless managers practice without even getting the broker’s license. For instance, the manager of a 22-unit Upper West Side co-op in Manhattan has operated as the agent for the property for almost a decade with impunity. Jones says that he is not alone. “A great many managers are functioning without brokers licenses. You can become a manager without a broker’s license. The law is not strictly enforced.”

without one.Or, practically, they can do nothing at all. According to many in the industry, countless managers practice without even getting the broker’s license. For instance, the manager of a 22-unit Upper West Side co-op in Manhattan has operated as the agent for the property for almost a decade with impunity. Jones says that he is not alone. “A great many managers are functioning without brokers licenses. You can become a manager without a broker’s license. The law is not strictly enforced.”

There are a number of reasons why. Some operate under the premise that only the principal in the firm needs to have a license. Others interpret the broker law as not being applicable to them since it states that agents must have a license in order to collect rents. Because co-op managers collect maintenance and/or common charges, no diploma is necessary.

Even if both arguments are wrong, most managers have little to fear legally. To track down unlicensed brokers, the state relies on complaints from the general public. Any cases are turned over to state investigators and charges are made by the attorney general’s office. The fines are underwhelming to non-existent: operating without a broker’s license is a misdemeanor. Theresa Wright, a spokesperson for the Division of Licensing Services, could not report any case of a manager losing his broker’s license or being penalized for operating

STATUS QUO?

So what is the result of this? An industry in which managers can – and often do – operate without proper supervision, punishment, and education. Incompetence occurs more often than not, and the business leaves itself open for corruption.

After the last round of indictments, State Senator Karl Kruger (D-Brooklyn) drafted a bill to require management licensing. Among its features were annual registration of residential managers, judicial review, education and renewal requirements, and a provision for penalties.

Predictably, a democratic bill in a Republican-run body went nowhere. But there is more than partisan politics at stake. There is industry politics. Although many say they want licensing, a greater number seem to be against it. For instance, REBNY, the largest industry trade group, is opposed to Kruger’s bill, arguing that the current licensing requirements do not need a major overhaul – just tinkering.

“There are already requirements in place,” says REBNY’s Davenport. “The goal of the broker licensing law was to be as comprehensive as possible. Our position is that you can make it better. We are not advocating a new license. Over the years, we have made suggestions for ways to improve the law, but the legislature has not acted. We also feel we cannot support legislation geared towards specific certifications. No one in the industry wants to limit choices.”

There are possible financial reasons behind such opposition. “REBNY is against it because the organization is controlled by large real estate owners and they do not want to have to pay for education or higher salaries,” says the principal of a mid-sized management firm. “REBNY has a lot of power in Albany.”

“REBNY doesn’t want to see licensing go through,” observes Greg Carlson, principal in Carlson Realty and executive director of the Federation of New York Housing Cooperatives. “When you get down to it, it’s a fight over who’s going to control the educational piece of the pie. REBNY makes a lot of money on its membership and course fees – for its broker broker license program, salesman license program, continuing ed program.”

Carlson adds that the rental industry is also against licensing because “they fear will it will cost them more money for their property managers, who will demand more as licensed managers.”

Davenport says that such arguments are untrue. “If there were required management educational requirements, we would be in the forefront of that. There is no conflict of interest [in our opposition].” She adds that many agents do not want additional red tape or the costs of further licensing. “There are already requirements. We don’t want to put people in the position to meet multiple requirements.”

Then there is the honesty argument: you cannot legislate integrity. After all, licenses among lawyers and accountants do not stop corruption there. And if the threat of jail doesn’t hold them, what will threat of license revocation mean?

“The broker licensing has a code of conduct. If you’re convicted of a felony, you can lose your license; that’s adequate,” says Gerard J. Picaso, principal in Gerard J. Picaso, a management firm. “All those people were caught [in the Manhattan District Attorney’s kickback investigation], people still kept doing it, even though they knew an investigation was underway. Bad people do bad things no matter what the consequences.”

But can licensing mitigate some criminality? “The threat of eliminating someone’s ability to work is very powerful,” says J. Brian Peters, director of management at Rose Associates. “It may, in fact be easier to enforce that than to try and bring a legal case beyond a reasonable doubt that somebody was a crook. We have the lesson of these two rounds of indictments. The district attorney was successful in bringing the indictments, but the actual number of those convicted is relatively low because of the high standard needed for conviction. You would not need as high a standard to revoke a license.”

“This is not a panacea which will insure honesty and integrity,” admits Kuperberg. “I agree: you can’t legislate honesty. However, with mandatory certification, you can create several positive results. One would be a central registration system of all managers so that if someone is indicted or convicted of a crime, it would be on record.”

Currently, after paying a fine or doing jail time, a convicted manager can – and often does – go back to work as an agent and boards are none the wiser. “You have all those people who pled guilty to kickbacks and they’re still managing,” Kuperberg says. “That’s ridiculous. If you you lose a license of certification, you lose the ability to ply your trade. That makes it worth keeping, and they may think twice about jeopardizing it.”

A management license could also improve the image of the manager as a professional, and could help recruit newcomers to the industry. “If you’re an accountant, or a CPA, or an attorney it means something to obtain a license,” Kuperberg says. “You work and study for it. I don’t know anyone who goes to college and says I want to be a property manager. Everyone has fallen into it. This would make it more of a profession.”

A management license could also improve the image of the manager as a professional, and could help recruit newcomers to the industry. “If you’re an accountant, or a CPA, or an attorney it means something to obtain a license,” Kuperberg says. “You work and study for it. I don’t know anyone who goes to college and says I want to be a property manager. Everyone has fallen into it. This would make it more of a profession.”

“My personal view is that co-op boards often view the manager as just another another vendor,” says PRC’s Khazzam. “They try and knock them down on fees, and as a result, you get the minimum level of fees. The work suffers because the agent is not viewed as a professional. Licensing and certification would help that.”

BUT WHAT STANDARDS?

Just as important – and perhaps the biggest road block – is deciding what kind of standards are needed. License requirements should start with the question, “What do managers do and who does this kind of work?” says NAHC’s Kleine, who adds that licensing discussions “need to address the ‘who.’ Should the firm be licensed or the individual? If the individual, which ones – principal, comptroller, property manager, site manager? If the firm is to be licensed, what are the licensing criteria? Firms don’t have education or experience, people do. Firms can’t be tested. Firms can’t be put in jail. Most licenses of firms simply require that they have adequate insurance. Remember, buildings do not have to hire a firm. They can self-manage and they can staff manage. And then defining the licensee and the bottom can be slippery. When I was president of a 90-unit townhouse association with a budget of $50,000, one proposal by the realtors in Virginia would have required our treasurer to get a license because we paid her $600 a year.”

There are are other areas to define. Is mandatory certification sufficient or should there be state-supervised licensing? Kuperberg is “strongly in favor of mandatory certification [because] licensing to me assumes a governmental-issued and overseen program along with whatever tests and procedures a governmental agency puts in place. That’s a lot of red tape. And every licensing regulation proposed [under state law] ends up being has been so watered down my 15-year-old son could pass. I don’t think the Department of State has the wherewithal or expertise to come up with something. There are several existing property manager certifications. One of those should be made mandatory.”

Any license should establish a baseline level of competence. “A continuing education requirement would help standardize the basic knowledge and qualifications of people within the field and help establish a threshold level of ability before somebody could be professionally involved in management,” Peters says.

“The benefits, especially for co-op or condo boards who come to their roles without real estate experience, is that they know they have a manager who has a minimal education,” Carlson says. “Licensing will not cut out fraud, or negligence, or stupidity, but it does tells the boards that they have someone running the property who has, at least, a minimum knowledge of the business.”

So, where does licensing stand? The industry says it is up to the legislature. The attorney general’s office, which regulates co-ops, also says it is waiting for the state lawmakers. But the legislature bows to lobbyists and the industry’s wishes. Until the trade associations get together and agree on a common goal, the politicians will not act. “As long as they’re split, nothing will happen,” NAHC’s Kleine says. “The turf wars in the industry and the money from lobbyists stop action in such situations.”

“There really isn’t a body that gets together on a non-competitive basis,” says Khazzam. “There is no body that speaks as one, providing unity and dialogue within the industry. Somebody has to stand up and unite; management companies have to get together and have a summit on the industry, but that’s nowhere near happening. We are so much at each other’s throats.”

“If all the trade groups would get together and set up a committee to work it out, something can happen,” Wolfe adds. “There should be a consensus. No one can convince me that a broker license is enough. All these organizations have different interests; if they could get together, legislation could more easily be accepted and passed.”

For change to occur, the bottom line is simple: co-op and condo owners need to get mad as hell and say they’re not going to take it anymore. “If boards push for it, more managers will get behind it,” argues Khazzam. “But you have a difficulty because of the nature of boards. They are volunteer, with a one-year term situation Once you educate him about why management licensing is needed, he’s gone and the process starts all over again. Ultimately, your client has to make that push.”

As long as boards accept the status quo, nothing will happen, except perhaps more incompetence, more indictments, and more trouble for an industry that, in general, insists on keeping its head in the sand. The issues are stark: the manager is often responsible for the financial life or death of a co-op or condo, and must guide a frequently unskilled and untrained, part-time volunteer board.

“In order to qualify to manage millions of dollars of money for clients all an agent has to show is a slip of paper that says he had 45 hours of schooling as a broker,” Kuperberg says. “Learning how to list exclusives is not a skill you need to have for management.”